tucson sales tax rate 2019

There are a total of 80 local tax jurisdictions across the state. The average sales tax rate in Arizona is 7695.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

This includes the rates on the state county city and special levels.

. Rates include state county and city taxes. The Arizona sales tax rate is currently 56. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No. This rate includes any state county city and local sales taxes. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112.

The minimum combined 2022 sales tax rate for Tucson Arizona is 87. Changes Effective October 1 2019 City of South Tucson. Effective July 01 2009 the per room per night surcharge will be 2.

Effective July 01 2003 the tax rate increased to 600. Sales Tax Increase Effective October 1 2019 Methods of Notification. The average cumulative sales tax rate in Tucson Arizona is 801.

The December 2020 total local sales tax rate was also 8700. The latest sales tax rate for Tucson AZ. The minimum combined 2022 sales tax rate for Tucson Arizona is 87.

Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53. The average sales tax rate in Arizona is 7695. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent.

If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower. The County sales tax rate is 0. Wayfair Inc affect Arizona.

Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the model tax code. The decision on Tuesday raises the total sales tax inside the square-mile city to 111 compared to the city of Tucsons total sales tax rate of 87. Updated Jul 22 2019.

860 Is this data incorrect Download all Arizona sales tax rates by zip code. Effective July 01 2003 the tax rate increased to 600. Method to calculate New Tucson sales tax in 2021.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

This is the total of state county and city sales tax rates. Lowest sales tax 56 Highest sales tax 111 Arizona Sales Tax. Tucson is located within Pima County ArizonaWithin Tucson there are around 52 zip codes with the most populous zip code being 85705As far as sales tax goes the zip code with the highest sales tax is 85725 and the zip code with the.

Method to calculate Tucson sales tax in 2021. Tucson Sales Tax Rates for 2022. 2022 List of Arizona Local Sales Tax Rates.

Tucson AZ Sales Tax Rate. Sales Tax Increase Effective October 1 2019 Methods of Notification. The Tucson sales tax rate is 26.

Fast Easy Tax Solutions. The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same business activities. The sales tax jurisdiction name is Arizona which may refer to a local government division.

Yuma AZ Sales Tax Rate. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112.

Maricopa County Local General Sales Tax AZ State Sales Tax Apache Junction 400 560 Avondale 320 560 Buckeye 370 560 Carefree 370 560. Tempe Junction AZ Sales Tax Rate. Did South Dakota v.

Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. You can print a. The latest sales tax rates for cities in Arizona AZ state.

Retail Sales 017 to five percent 50 Communications 005 to five and one-half percent 55 and Utilities 004 to five and one-half percent 55. 1 TPT News and Updates Newsletters which is placed on the website social media and GovDelivery every 20th or so of the. The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson.

19-01 to increase the following tax rates. Average Sales Tax With Local. A 1500 refrigerator purchased in Marana where the sales.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables. 2020 rates included for use while preparing your income tax deduction. There is no applicable special tax.

The sales tax increase is aimed at the business categories because they are currently taxed below the average across all categories of 55 percent. Groceries are exempt from the Tucson and Arizona state sales taxes. Sales Tax Rates Effective April 1 2019 Combined List 2202019 30221 PM.

The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. Ad Find Out Sales Tax Rates For Free.

This is especially important to note if you are an annual filer as the city tax rate has increased from the return filed for 2017. Three cities follow with combined rates of 10 percent or higher. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

The South Tucson City Council is considering raising sales taxes by half a percent on utilities communications and retail sales to sustain an estimated budget deficit of 293000 in 2020. 2020 rates included for use while preparing your income tax deduction. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax.

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

State And Local Taxes In Arizona Lexology

A Complete Guide On Car Sales Tax By State Shift

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

Property Taxes In Arizona Lexology

How To Calculate Sales Tax For Your Online Store

State And Local Taxes In Arizona Lexology

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

2021 Arizona Car Sales Tax Calculator Valley Chevy

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

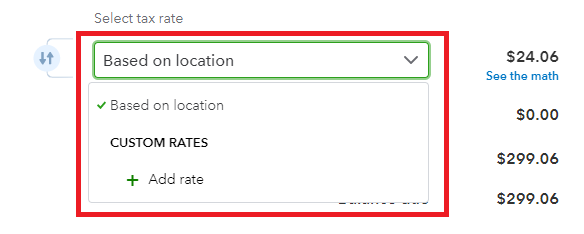

How To Process Sales Tax In Quickbooks Online

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation