how to calculate nj taxable wages

New Jersey Paycheck Calculator - SmartAsset. To execute payroll for employees a business must know how to calculate taxable wages.

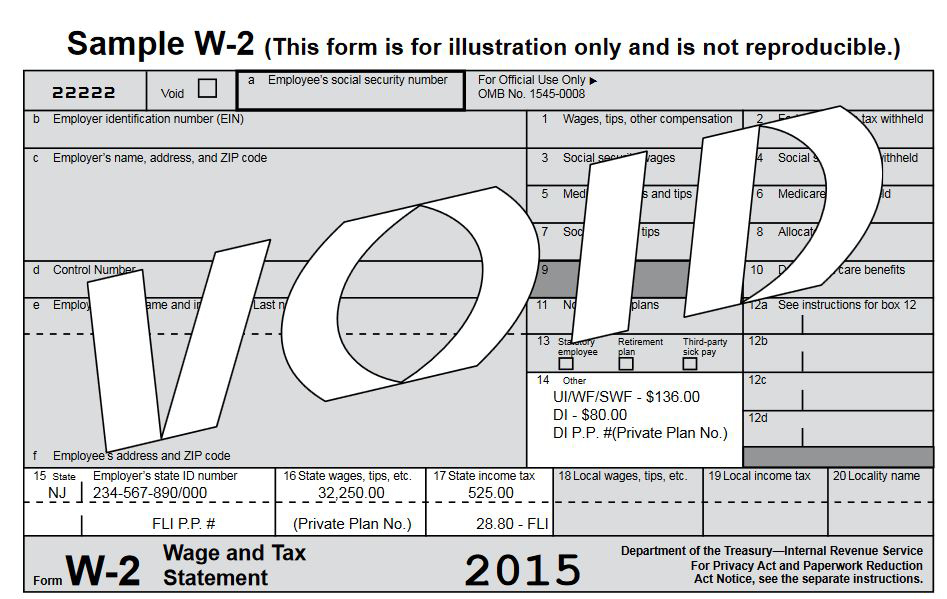

Solved I Received State Disability From New Jersey Is That Taxable I Do Not Have A 1099 G I Have A Form W 2 With Money On Number One For Wages

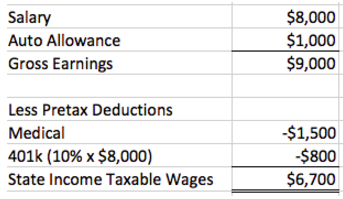

Here is the formula for calculating taxable wages.

. The Taxable Wage Base is the. How to calculate taxable wages 1. New jersey workers contribute to the cost of temporary disability and.

For each employee enter the portion of the wages paid in this quarter that exceeds the taxable wage base for this calendar year. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table. Because of these and other differences you must take the amount of wages from the State wages box on your W-2s Box 16.

Enter your salary or wages then choose the frequency at which you are paid. If none enter zero 0. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

Also check your W-2 to confirm that New Jersey. Using The Hourly Wage Tax Calculator. Gross wages are the starting point from which the IRS calculates an individuals tax liability.

1300 112022 1200 112021 Unemployment. Annual Taxable Wages SUTA Wages up to state limit per employee SUTA Liability SUTA wages SUTA rate Barry 28000 7000 Jordan 50000 7000 Total 78000 14000. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the.

Taxable Wages for UIET. 2020 Taxable Wage Base UI and WFSWF - workers and employers TDI employers. Your average tax rate is 1198 and your marginal.

Using our New Jersey Salary Tax Calculator. This marginal tax rate. Taxable Wages for SDI.

The NJ Tax Calculator calculates Federal Taxes where applicable Medicare. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and. You just need to click to get the search information.

Governmental entities or instrumentalities that elect to reimburse the cost of benefit payments in lieu of contributions deduct worker contributions of 0425 of taxable wages. Your average tax rate is 1198 and your marginal tax rate is 22. How To Calculate Medicare Taxable Wages is a platform created to assist users in taking care of themselves and their families.

The Ascent goes through how to calculate taxed wages in this guide. Details of the personal income tax rates used in the 2022 new jersey state calculator are published below the. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

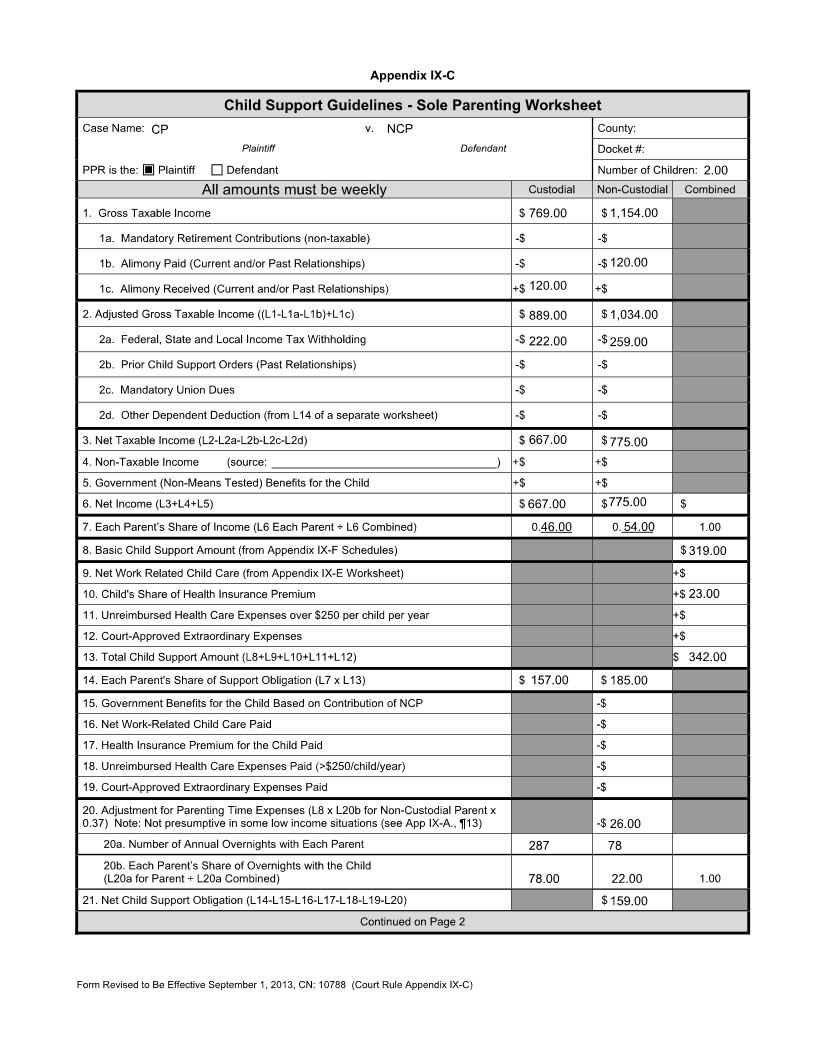

How Much Child Support Will I Pay In New Jersey

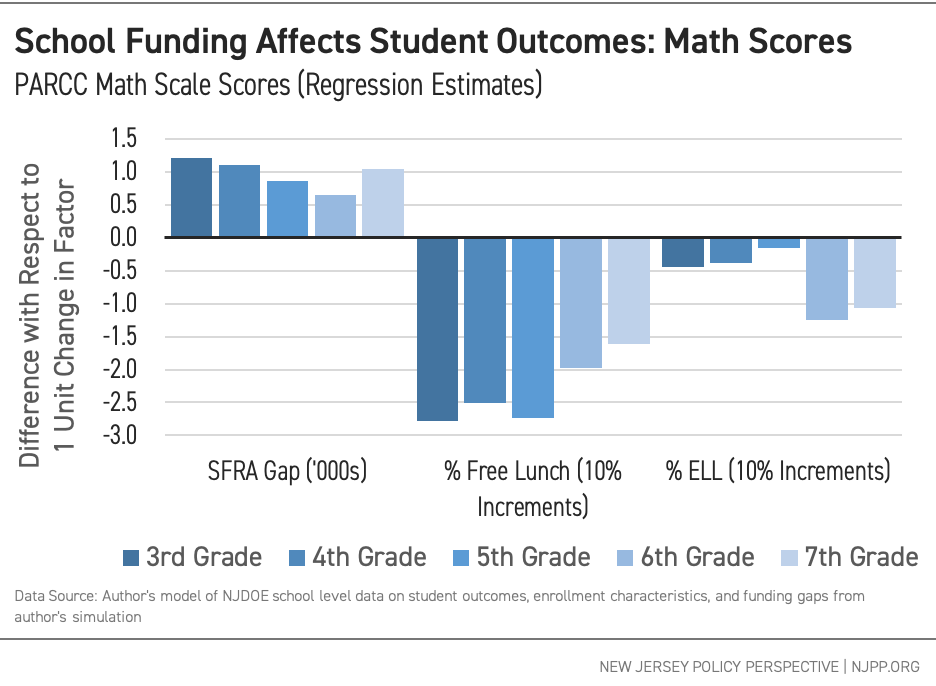

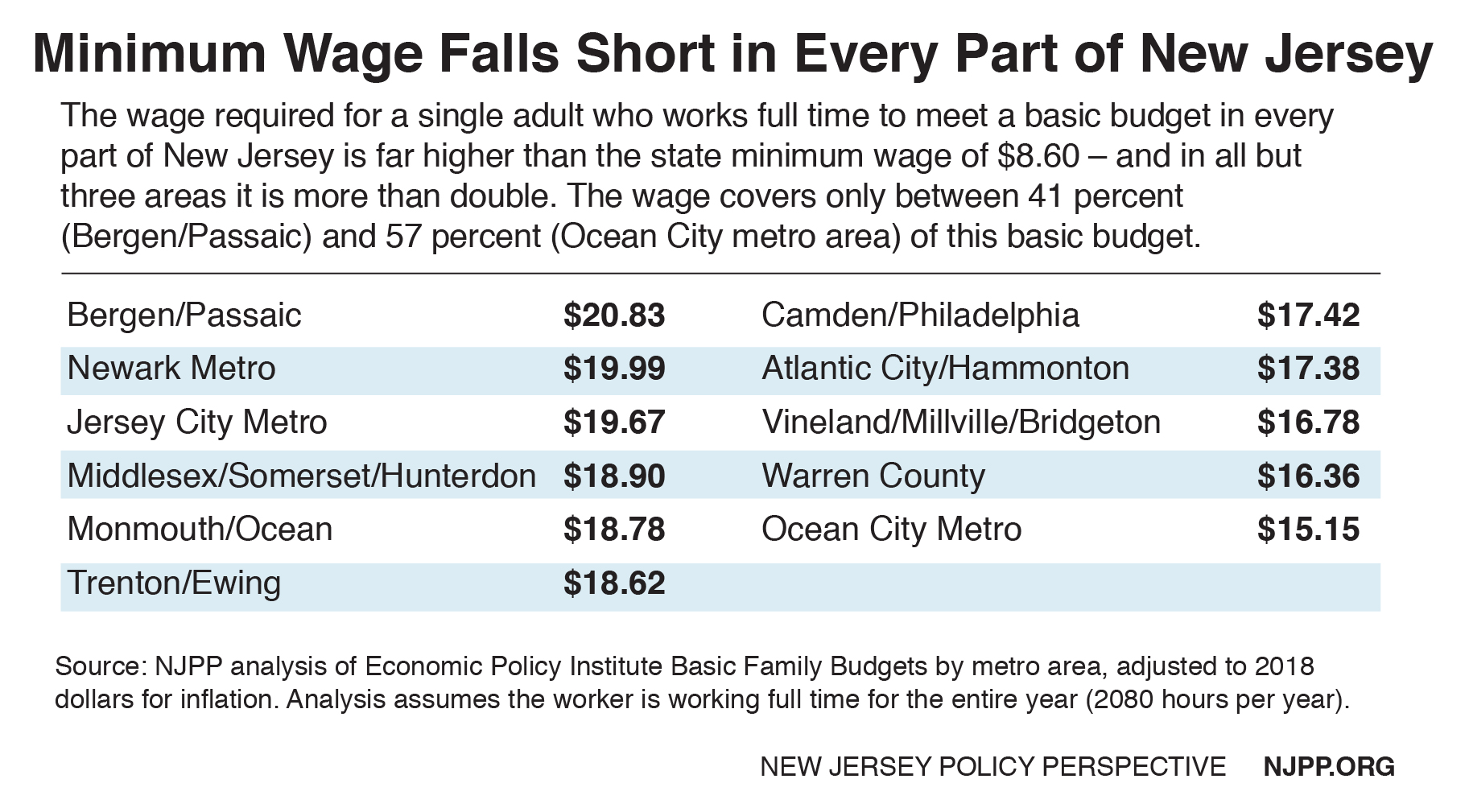

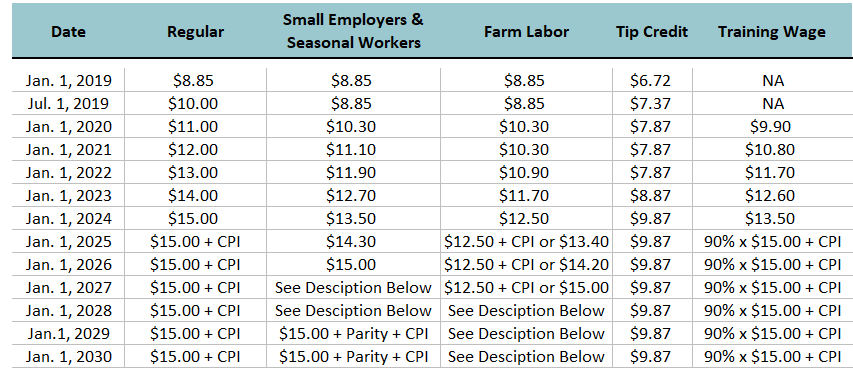

A 15 Minimum Wage Would Help Over 1 Million Workers And Boost New Jersey S Economy New Jersey Policy Perspective

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

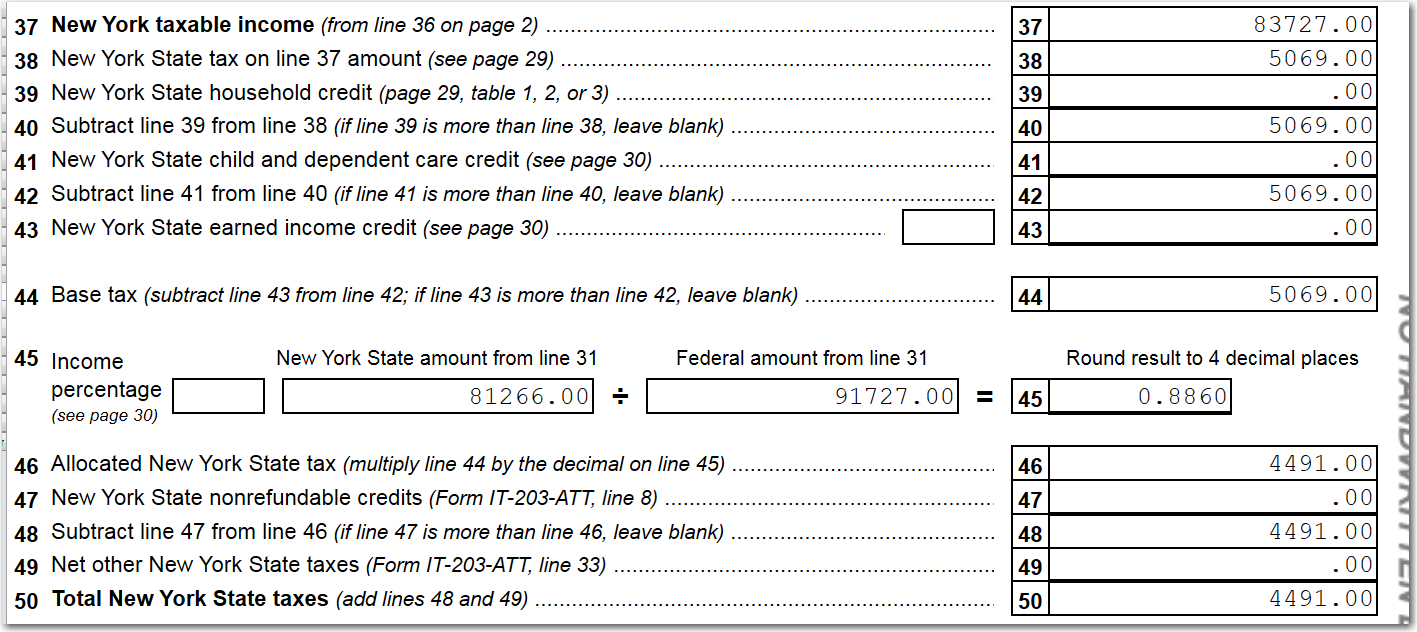

Nj Full Year Resident Ny Wages General Chat Atx Community

How To Calculate Taxable Income H R Block

Tax Withholding For Pensions And Social Security Sensible Money

Nj Division Of Taxation Common Filing Mistakes

State Income Tax Rates Highest Lowest 2021 Changes

How Are Payroll Taxes Calculated State Income Taxes Workest

Individual Income Taxes Urban Institute

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Prepare E File 2021 New Jersey Income Tax Returns Due In 2022

Nj Temporary Disability Insurance Rates For 2022 Shelterpoint

New Jersey Extends Retirement Income Exclusion Kulzer Dipadova P A

Salary Paycheck Calculator Calculate Net Income Adp

Minimum Wage Law P L 2019 C 32 Njbia